ESG REPORT

The Carbon Border Adjustment Mechanism (CBAM) is a new policy by the European Union to support its climate goals under the Fit for 55 package, which aims to cut greenhouse gas emissions by 55% by 2030. The idea behind CBAM is simple: products imported into the EU should face the same carbon costs as goods produced within the EU. This prevents “carbon leakage,” where companies might otherwise move production to countries with weaker climate rules, and it ensures fair competition for EU industries already paying for their emissions through the EU Emissions Trading System (EU ETS).

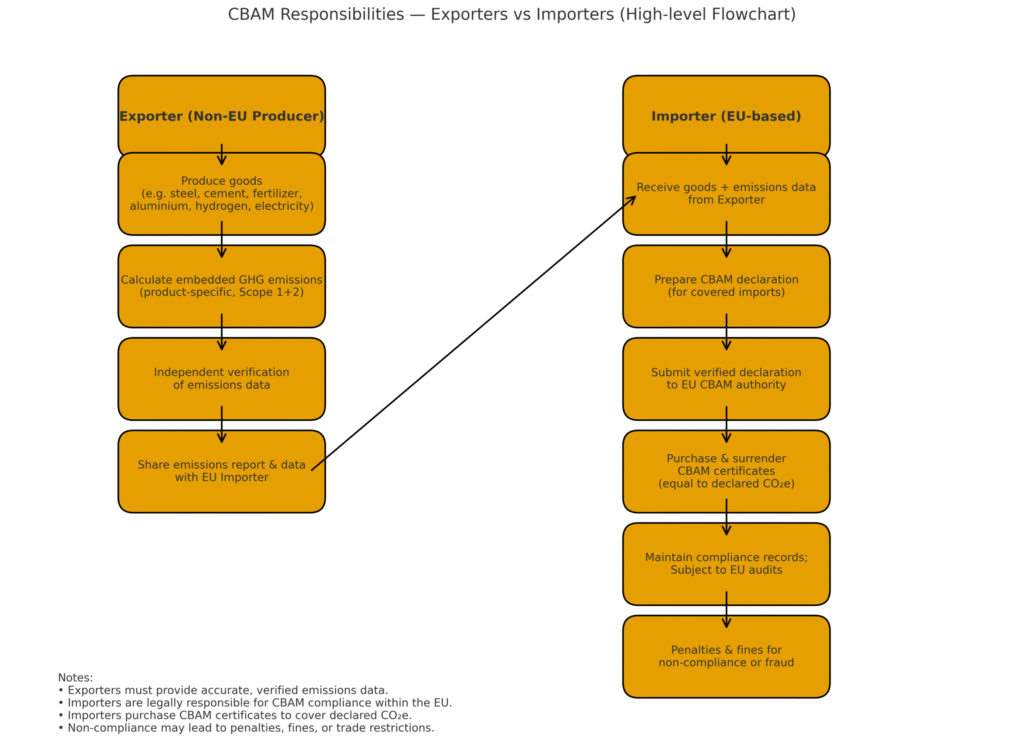

CBAM currently applies to the most carbon-intensive sectors such as iron and steel, aluminium, cement, fertilisers, electricity, hydrogen, and certain semi-finished goods. Importers of these products must report the amount of greenhouse gases released during production and, once CBAM is fully in place, buy CBAM certificates to cover those emissions. The price of these certificates will be directly linked to the EU ETS carbon price, while any carbon price already paid in the exporting country will be deducted. This way, the system is both fair and transparent.

The rollout of CBAM happens in two stages. In the transition phase (October 2023 to December 2025), companies must submit quarterly reports on the emissions linked to their imports but do not yet need to buy certificates. This period is mainly for data collection and adjustment. From January 2026, CBAM enters full operation. At that point, importers must be authorized, have their emissions data verified by accredited bodies, purchase the necessary number of certificates, and file an annual declaration by 31 May each year.

For businesses outside the EU, CBAM means that exporting carbon-intensive goods to Europe will come with new costs unless they adopt cleaner production methods. For EU importers, it means higher costs for carbon-heavy goods, greater focus on greener suppliers, and new reporting responsibilities. While this adds an administrative burden, it also pushes global supply chains toward sustainability. In short, CBAM is not just a regulation—it is a powerful tool driving industries worldwide toward a low-carbon future.